Electronic invoicing is currently not mandatory in Thailand. However, the Thai government is taking steps towards digitizing the tax system to create a comprehensive digital tax ecosystem that should be available by 2028.

In 2016, the Thai government introduced a new policy called “Thailand 4.0”, which includes two main long-term objectives: to transform Thailand into a digital economy, and for it to become an advanced economic nation 2032. To achieve those objectives, the Thai government together with The Electronic Transactions Development Agency (ETDA), which is the main agency responsible for standards and the development, promotion and support of electronic transactions in the country, is promoting e-invoicing and encouraging companies to make the switch.

The e-tax system in Thailand is intended to replace paper-based tax invoices in many common business transactions. It is already possible for VAT parties to send e-invoices and receipts voluntarily using the e-Tax Invoice and Receipt system (which is dedicated to e-invoicing). The Thai Tax Authority has also taken steps to expand its infrastructure for electronic invoice exchange and reporting of account and tax information to be built with specialized service providers.

The timeline for using the e-invoicing system depends on a company’s size:

The full implementation of the Thai government's plan to implement e-invoicing will take place in stages:

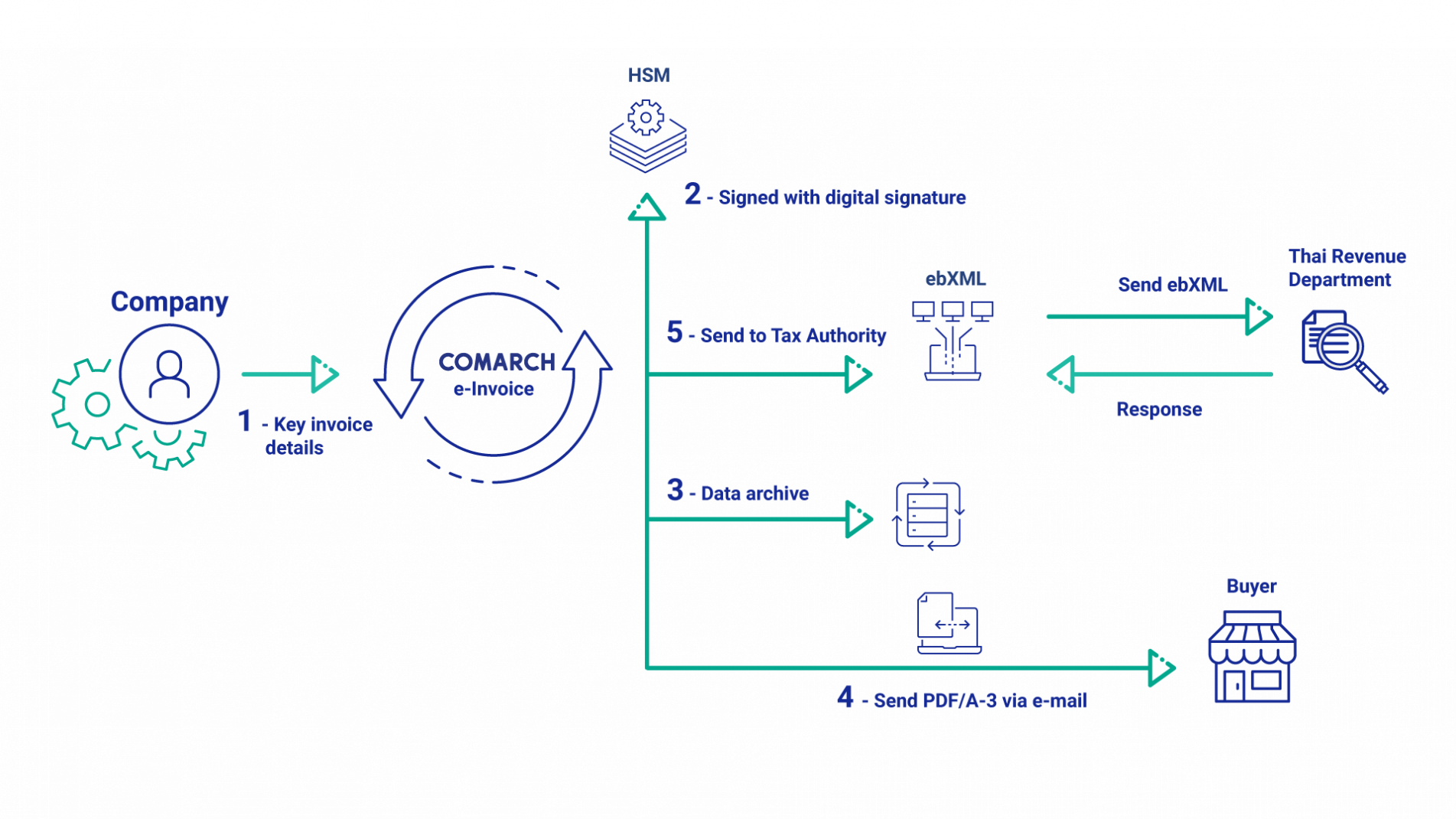

The Thai e-invoicing system cannot be considered as a full clearing model. This is due to the fact that only the data contained in e-invoices are transferred to the Thai tax authorities (ETDA), while the e-invoices themselves are transferred directly by the seller to their recipients. Prior notification is required to issue e-invoices to the central system run by the Thai tax authorities of such desires. All e-invoices must meet certain requirements: firstly, they must be digitally signed and, moreover, they must have an electronic time stamp confirming the date of issue and must contain defined information. Data from invoices issued in this way are delivered to the Thai tax authority by the 15th day of the month, in monthly cycles.

Since tax e-invoicing involves undertaking complex technical and legal steps by enterprises, the government is trying to support them and optimize the process of switching to e-invoicing. One of the activities is the initiative of the Agency for the Development of Electronic Transactions, under which the certification process ("ETDA") is conducted for e-service providers in order to assess their security and compliance. As a result, Comarch obtained an official certificate as a provider of data transmission services in the field of electronic invoicing and tax receipt (Service Provider Certified).

E-invoices and e-receipts must contain two digital signatures created by the prescribed means and supported by a certificate and the signatory’s certificate number. This number is issued by the approved certification body of the tax authority.

Invoices may be in XML format (ETDA Standard).

Documents prepared in electronic form and with digital signatures the original is an electronic file, so the document must be stored in electronic form (if printed on paper, it will be considered a copy) based on the Electronic Transactions Act.

Tax invoice, report, copy of tax invoice as well as supporting documents shall be kept at least 5 years as from the date of tax return filing or report making.

Comarch is certified as a data delivery service provider for electronic tax invoicing, receipts and can exchange documents through the government’s e-Tax Invoice & Receipt system.

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.