Comarch EDI Ready for Obligatory

e-Invoicing in Poland!

Master structured invoicing in Poland and compare local KSeF standards with global best practices in 70+ countries.

Master structured invoicing in Poland and compare local KSeF standards with global best practices in 70+ countries.

Soon, Poland will become another European Union country to change the model of electronic invoice processing from the post-audit model to the clearance model. From January 1, 2022, the KSeF (National System of E-Invoices) has been in operation in Poland and since then it has been possible to voluntarily exchange structured invoices. KSeF was introduced to enable data exchange, issuing, receiving and storing structured invoices in the area of B2B invoicing.

During a press briefing on January 19th, 2024 Poland’s Minister of Finance announced a postponement of the National e-Invoice System (Krajowy System e-Faktur, KSeF) obligation introduction. A nationwide mandate set to take effect on July 1st, 2024, has been postponed to 2026. From the moment it is fully implemented, the obligation to issue structured invoices using KSeF will apply to taxpayers carrying out activities subject to the obligation to invoice in accordance with Polish VAT regulations.

As a rule, these will be domestic and foreign deliveries of goods and the provision of services between entrepreneurs (B2B) and for public authorities (B2G). It will also apply to foreign taxpayers performing activities subject to the invoicing requirement according to Polish VAT regulations, who have their registered office or permanent place of business in Poland. As a result of public consultations, invoices issued to natural persons not conducting business activity (B2C) were excluded from e-invoicing.

As of now, electronic invoice exchange is not yet fully mandatory for B2G or B2B transaction in Poland. However, public institutions have been obliged to receive e-invoices from their suppliers on demand since 2019.

With the progress of digitization in mind, The Ministry of Finance wants KSeF to implement a mandatory solution covering almost all transactions. From February 1st, 2026, e-invoicing is already mandatory for entities whose sales value in the previous tax year exceeded PLN 200 million.

There are two more stages to come:

In 2019, a special e-invoicing platform was made available for issuing invoices to government organizations: Electronic Invoicing Platform - PEF. In the area of B2B invoicing, the National e-Invoice System (KSeF) was introduced on an optional basis in 2022, enabling the issuance, receipt and storage of structured invoices. It is also used to mark invoices with an identification number, and to check the compliance of invoices with a specific template. Both systems, KSeF and PEF, currently operate independently.

However, the implementation of KSeF will affect the current system of handling electronic invoicing in public procurement using PEF. The legislator provides a solution ensuring interoperability of PEF and KSeF systems. Invoices issued in PEF, after positive validation, should receive a KSeF/UPO number and should be made available to the issuer of such an invoice in PEF.

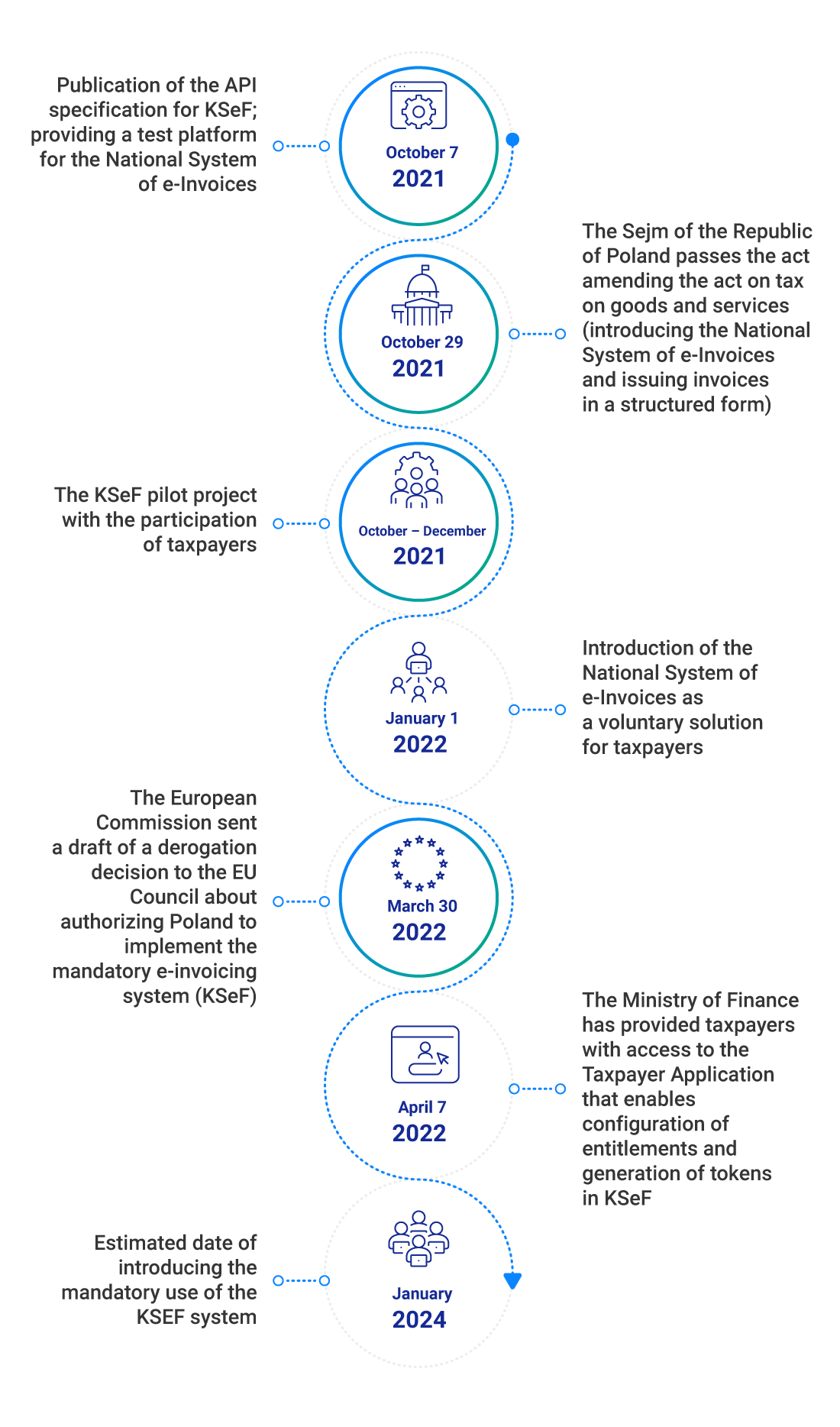

2021

2021Publication of the API specification for KSeF; providing a test platform for the National System of e-Invoices

The Sejm of the Republic of Poland passes the act amending the act on tax on goods and services (introducing the National System of e-Invoices and issuing invoices in a structured form)

The KSeF pilot project with the participation of taxpayers

2022

2022Introduction of the National System of e-Invoices as a voluntary solution for taxpayers

The European Commission sent a draft of a derogation decision to the EU Council about authorizing Poland to implement the mandatory e-invoicing system (KSeF)

The Ministry of Finance has provided taxpayers with access to the Taxpayer Application that enables configuration of entitlements and generation of tokens in KSeF

2024

2024Poland's Minister of Finance annunced a postponement of the National e-Invoice System (Krajowy System e-Faktur KSeF) obligation introduction.

Polish President Andrzej Duda signed an amendment to the previously applicable regulations specifying the date of entry into force of the obligation to use KSeF. Date for the obligation to use the National e-Invoice System has been postponed to February 1, 2026.

2025

2025Publication of the FA(3) logical structure on ePUAP and release of the KSeF 2.0 API documentation.

Completion of the legislative process.

Open tests for the KSeF 2.0 API started on September 30, 2025, the pre-production environment was opened in mid-October 2025, and the KSeF 2.0 production system will go live technically on February 1, 2026, following deactivation of some elements on September 1, 2025.

Issuance of invoice issuer certificates by entrepreneurs. Release of the test version of the KSeF 2.0 Taxpayer Application.

2026

2026KSeF 2.0 becomes mandatory-Stage I.

KSeF 2.0 becomes mandatory-Stage II.

2027

2027Obligation begins for “digitally excluded” taxpayers whose transactions involve small amounts (up to PLN 450 per invoice and a total monthly sales value of up to PLN 10,000)-Stage III.

Based on the act passed by the Sejm of the Republic of Poland, a structured invoice should be issued and received via the KSeF, using interface software. It has an electronic form and is created in accordance with the provided template. The e-invoice must be presented in XML format in accordance with the logical structure of e-Invoices (FA_VAT). It is, therefore the third type of invoice next to paper and electronic invoices that are in force in Poland. After e-invoices are delivered to KSeF, they will be provided with a time stamp and a unique identification number (KSeF ID), and the official receipt (UPO) will be returned to the invoice issuer.

Access to the National System of E-invoices may be obtained by a taxpayer, an authorized person, an authorized entity, or one of the entities referred to in Art. 106c of the Act, as long as they are authorized to issue (or make available) structured invoices. The legislator is to ensure the possibility of issuing a structured invoice via a dedicated platform for micro-enterprises (directly in the system via a web interface). Another option is to prepare invoices in the taxpayers' ERP systems accordingly to the published template. In the case of issuing invoices using an in-house financial and accounting system, the documents should be delivered to KSeF via a defined link, for example, via Comarch EDI to KSeF API.

As an operator of electronic document exchange (including e-invoices), Comarch monitors legislative changes in Polish law on an ongoing basis. We were very involved in the KSeF pilot project, and our specialists are present at meetings during which technical details of the system, structural invoice specification and API documentation are discussed.

The API of the National System of E-invoices is to enable integration with Comarch EDI (used by thousands of customers in Poland and abroad). This means that all users of our platform are able to send and receive e-invoices to/from KSeF. Comarch EDI also ensure full compliance with the latest regulations and transparency of the circulation of all invoices (and their statuses).

Comarch EDI clients have 2 integration and communication models to choose from for the interaction with the government KSeF system.

This process involves the exchange of e-invoices with basic technical validation, ensuring full compliance of invoices with the requirements of the KSeF scheme.

Step 1: Invoice submission to Comarch EDI

Step 2: Invoice authentication in the National e-Invoice System (KSeF).

The process includes:

Step 3: Downloading statuses and KSeF ID for a given invoice in Comarch EDI

Downloading KSeF feedback statuses and forwarding them to the invoice issuer.

Step 4: Receiving the invoice

Receipt of the invoice in the recipient’s internal system after prior token authentication. The invoice is transferred to the recipient after conversion from the KSeF XML format to the format required by the recipient’s system.

Storing invoices in Comarch EDI Archive is optional. There, invoices are stored in source and KSeF XML formats, along with invoice status and an official acknowledgment of receipt (UPO). Additionally, the history of KSeF unavailability and re-transmission to the National e-Invoice System is provided.

This model involves considering additional, specific customer requirements regarding invoice processing, for example, including business validations.

Step 1: Invoice submission to Comarch EDI

Step 2: Authentication of the invoice in the National e-Invoice System (KSeF)

This process includes:

Step 3: Downloading statuses and KSeF ID for a given invoice in Comarch EDI

Downloading KSeF feedback statuses and forwarding them to the invoice issuer.

Step 4: Receiving the invoice

Receipt of the invoice in the recipient’s internal system after prior token authentication. The invoice is transferred to the recipient after conversion from the KSeF XML format to he format required by the recipient’s system.

Storing invoices in the Comarch EDI Archive is optional. There, invoices are stored in source and KSeF XML formats, along with invoice status and an official acknowledgment of receipt (UPO). Additionally, the history of KSeF unavailability and re-transmission to the National e-Invoice System is provided.

All invoices must be structured and compliant with the KSeF

Comarch will take care of adjusting the format in which you send your invoices to the requirements imposed by KSeF. You don't have to waste time to manually adjust each invoice.

My customers and suppliers have different requirements as to the information included on the e-invoices. Aside from verifying whether the documents are compliant with KSeF specification, I also need business validation to meet also my partners’ expectations.

With Comarch, you can maintain the validation of multi-document processes. Thanks to this, you will be sure that all the required information is included in the invoice, even if the KSeF does not require it.

I want to have access to all of my documents any time I want to export an invoice that was previously registered in KSeF - together with all its history of statuses.

Comarch allows you to store KSeF XML invoices together with the history of KSeF statuses, invoice identification number or UPO (confirmation).

I want the system to be operated by true specialists with a lot of experience in similar projects.

Comarch has many years of experience in carrying out electronic documents exchange projects, which often include the management of processes related to sending and receiving documents to/from governmental institutions in many countries.

On January 19, 2024, the Minister of Finance announced that the obligation of e-invoicing will not be implemented according to the earlier plans, starting from July 1, 2024.

Based on the adopted changes, the date for the obligation to use the National e-Invoice System has been postponed to February 1, 2026.

To ensure integrity and authenticity of e-invoices, any method is accepted, such as Qualified Electronic Signature. Data sealed with a qualified electronic seal enjoy the presumption of integrity and authenticity.

Storage period 5 + 1 years.

Comarch is a global leader in Electronic Data Interchange (EDI) and e-invoicing. We have been actively involved in the KSeF project from its inception, participating in technical workshops and consulting directly with Polish legislative bodies.

Our solution, Comarch EDI, is a robust platform fully integrated with the government's KSeF system. It's an end-to-end service designed to manage the entire e-invoicing lifecycle in Poland, from sending and receiving invoices to validation and archiving. We ensure your business remains fully compliant with Polish regulations while maintaining transparency across your entire invoice workflow.

Our service is designed for all businesses that fall under the KSeF mandate. It covers all B2B invoices that must be cleared through the KSeF platform, not just those you may currently exchange via a traditional EDI connection.

We manage the authorization process using a secure authentication token. This method removes the technical burden from your team. Through our platform, you gain secure, on-demand access to all your invoices in the official KSeF XML format, complete with their entire status history, unique KSeF identification numbers, and the critical Official Confirmation of Receipt (UPO).

Yes, the Comarch EDI KSeF service provides the taxpayer with all return statuses, including the Official Confirmation of Receipt (UPO). These statuses, along with the UPO, are also available to the taxpayer from within the Comarch EDI Tracking and Comarch EDI Archive applications.

Comarch provides a comprehensive, managed service—not just a data pipeline. Our solution is designed to handle the complexities of the mandate so you can focus on your business.

Beyond bidirectional transmission, our service includes:

As part of our promotional offering, Comarch EDI allows you to test the connection to KSeF as well as to implement the production use of the system. Comarch EDI ensures your compliance with the latest legal regulations, as well as the transparency of your invoice flow and the monitoring of their statuses.

Within Comarch EDI KSeF, several methods of connecting to KSeF are available, ranging from a web page that allows you to prepare and receive e-invoices to/from KSeF, to the full integration of internal systems.

Users can opt for one of two models for exchanging invoices with the government's KSeF platform.

We invite you to request a personalized demo to see the Comarch EDI platform in action. During the demo, you can test the user-friendly interface and see how simple sending a compliant e-invoice can be.

For decades, we have supported thousands of companies across diverse industries worldwide. As global regulations evolve, we continually adapt our solutions to guarantee compliance for our clients. Let us show you how we can make KSeF a seamless part of your operations.

Within Comarch EDI KSeF, the system automatically transmits invoices to KSeF immediately after they are sent by the client. So, you can be sure that the issued documents won’t get lost and will reach the recipient without unnecessary delays. Issuing and transmitting invoices takes much less time than in the past.

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.

Click on the button to get in touch with one of our experts