Prepare Your Business for the UAE’s Mandatory E-Invoicing by 2027

Align your billing with the UAE’s specific standards while building a scalable strategy for the 70+ global jurisdictions now going digital.

Align your billing with the UAE’s specific standards while building a scalable strategy for the 70+ global jurisdictions now going digital.

The United Arab Emirates introduced VAT in 2018, and with it, a switch toward digitized tax processes inspired by global standards. Now, those changes are accelerating.

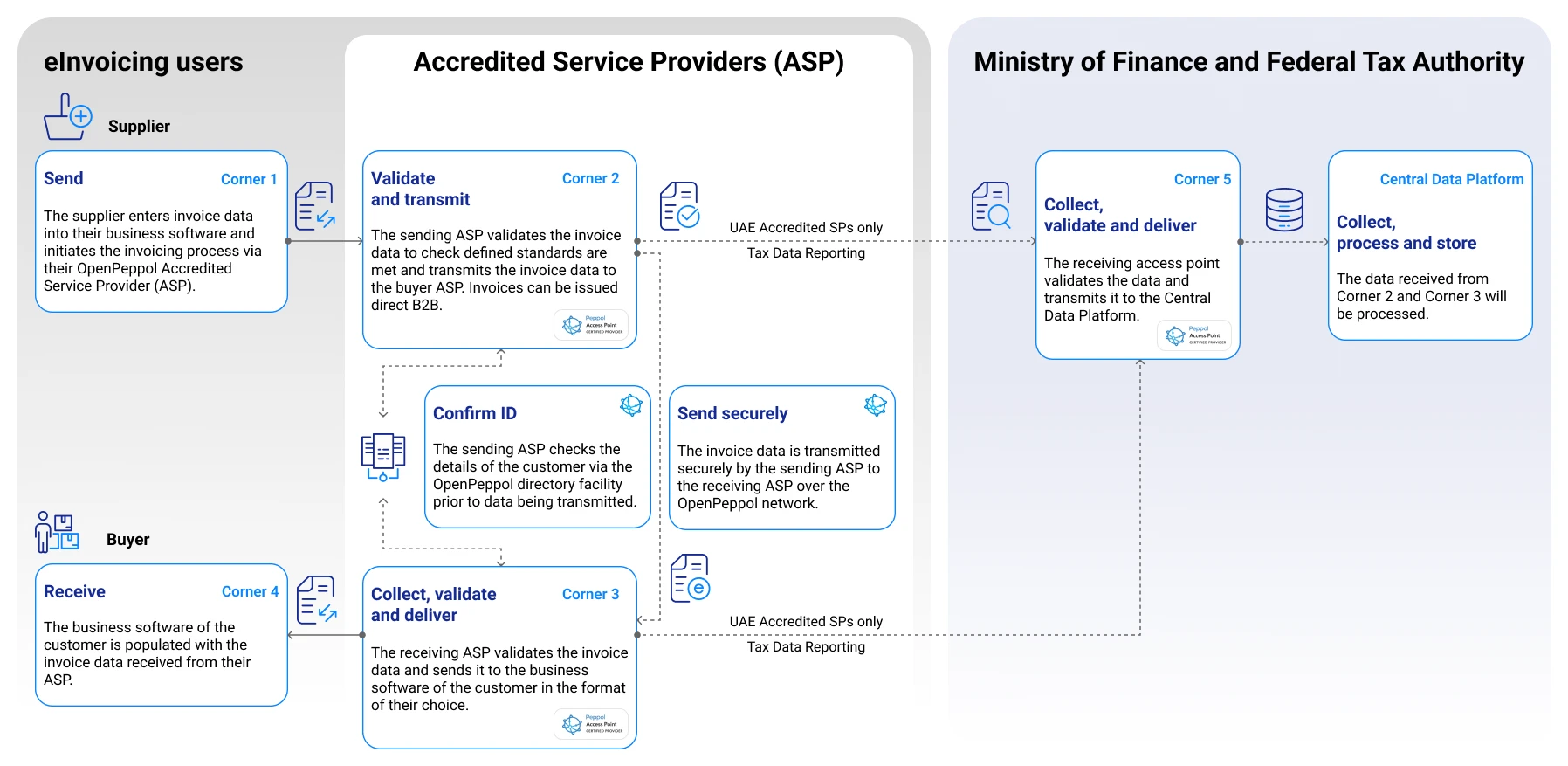

The UAE is currently in the implementation phase of a new, obligatory system based on the Peppol 5-corner infrastructure, facilitated exclusively by a network of Accredited Service Providers (ASPs). This initiative is part of a broader national plan to enhance transaction and reporting efficiency. It will introduce mandatory reporting to both AP and AR flows, with all taxpayers required to connect via ASPs.

On September 29, 2025, the new timeline for mandatory e-invoicing has been announced. The mandate is going to be introduced in stages:

Pilot Program & Voluntary Enrollment: Starting July 1, 2026, a pilot program will launch with a group of selected taxpayers. From that date onward, any business may choose to voluntarily participate in the system.

Phase 1

Phase 1 Phase 2

Phase 2 Phase 3

Phase 3The UAE plans to introduce the world’s first large-scale implementation of the Peppol

5-corner model, in which e-invoices are exchanged through Accredited Service Providers

(ASPs). Transaction reporting will be mandatory from day one.

E-invoicing is currently optional in the UAE, businesses may exchange e-invoices by mutual agreement. However, mandatory adoption is on the horizon. The government is preparing to digitize all taxpayer transactions with public entities.

For B2B and B2G transactions, as the required format of an e-invoice, the UAE has adopted PINT AE, a localized version of the Peppol International Invoice standard. This format ensures interoperability and compliance with FTA requirements.

Invoices must be stored securely to ensure their integrity, authenticity, and accessibility throughout the retention period, which is five years after the end of the tax period to which the invoice relates. Invoices do not have to be stored locally within the UAE.

Taxpayers must ensure that all electronic invoices remain tamper-proof and verifiable. While electronic signatures are regulated, they are not mandatory under current UAE guidelines.

Businesses may choose the method that best ensures document integrity and traceability. The UAE's Ministry of Finance has confirmed that the chosen solution is allowed to be based outside the UAE.

Comarch is undergoing the accreditation process with the goal of achieving full accreditation at the earliest possible date. We were among the first five entities included on a list of Pre-Approved Service Providers.

Currently, the list includes 9 companies with this status. Our global e-invoicing platform is already aligned with Peppol and PINT AE standards, and we're fully committed to supporting your business through every stage of the UAE's digital compliance transition.

Stay ahead of regulatory change. Download our guide for UAE-based CFOs, covering key risks, timelines, and key action points for finance teams. Get clear, practical advice from Comarch’s compliance experts.

Fully aligned with FTA and Peppol standards.

Automate invoices, reduce manual errors and costs.

Process-specific implementation, scalable to your business.

Secure infrastructure, 5-year archiving, data integrity guarantees.

Whether you're based in the UAE or operate regional branches, our experts can help you get fully prepared for the upcoming mandate. Let’s talk about how to future‑proof your billing and tax systems before 2027.

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.