Mandatory E-invoicing in Belgium

Eliminate compliance risks in Belgium and gain insights into the digital reporting rules of 70+ other regions.

Eliminate compliance risks in Belgium and gain insights into the digital reporting rules of 70+ other regions.

Belgium has already introduced mandatory e-invoicing for B2G transactions. All Belgian public bodies are already obliged to be able to receive and process electronic invoices in the context of public procurement, which makes it mandatory for all federal government suppliers to issue electronic invoices (transposition of Directive 2014/55/EU). This obligation applies to contracts above EUR 30,000, and from October 2023 it also covers contracts below this amount. Invoices with amounts below EUR 3,000 are exempt from electronically sending.

Currently, B2B e-invoicing is possibly provided when both parties, the seller and the buyer, agree to it. However, measures to reform the tax system, including the invoice exchange model and the transition to electronic invoicing, already started. The Belgian Ministry of Finance has announced that the reforms will focus on electronic invoicing in the private sector in B2B transactions. The main focus will be on reporting data from invoices. PEPPOL is likely to be the preferred standard for e-invoicing, which will include near-live e-reports to replace the annual customer inventory report.

Despite the planned implementation of mandatory electronic invoicing in 2024 due to the legislative impasse around comprehensive tax reforms in Belgium, and given the complexity of the Belgian legal framework, the implementation of e-invoicing was postponed to 2026.

1. Taxable persons exclusively performing VAT-exempt transactions under Article 44 of the Belgian VAT Code (e.g. specific medical services, cultural activities);

2. Taxable persons in a state of bankruptcy;

3. Taxable persons applying the flat-rate scheme under Article 56 of the Belgian VAT Code;

4. Transactions involving the supply of goods outside Belgium, where no Belgian Tax ID is required.

Since March 1, 2024, federal contracting authorities have also been required to implement electronic invoicing for transactions under €3,000. Beginning January 1, 2026, structured electronic invoicing will become mandatory for almost all B2B transactions conducted by Belgian enterprises subject to VAT. However, this requirement does not apply to goods or services supplied directly to consumers for private use (B2C transactions).

This structured invoicing requirement will generally apply to transactions between two Belgian VAT-liable enterprises, with a few exceptions:

Structured electronic invoices are not required for:

Additionally, there is no obligation to be able to receive structured electronic invoices for:

In general, if a transaction is VAT-exempt under Article 44 of the VAT Code, there is no requirement to send or receive structured electronic invoices.

There is no government platform. B2B e-invoices proceed via the Peppol network, in Peppol Bis format (unless by mutual agreement and in compliance with EN16931).

CEN Compliant formats can only be used for the transmission outside of Peppol.

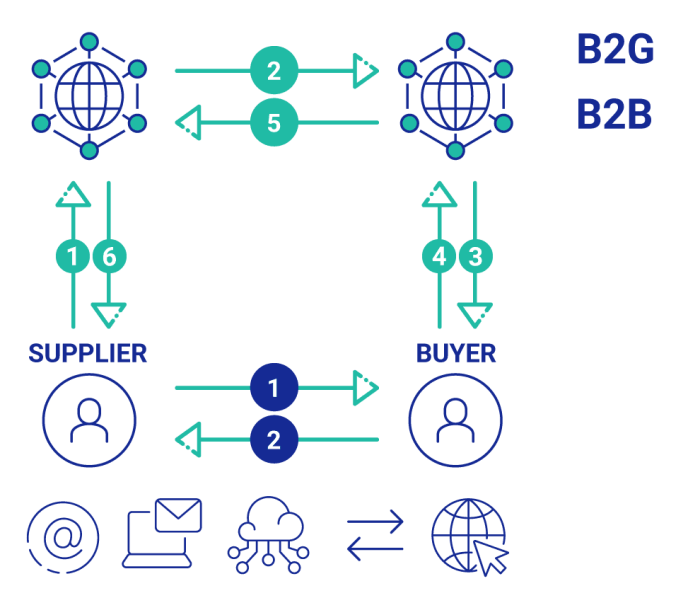

Comarch is a certified PEPPOL access point. Under the four-corner PEPPOL model, the buyer and supplier exchange invoices via an access point, which is a PEPPOL certified service provider that ensures data security and compliance with PEPPOL standards (for example, UBL format or AS4 communication protocol).

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

Make sure your business meets international standards with the Comarch e-Invoicing platform, trusted in more than 60 countries. Enjoy hassle-free integration and continuous compliance updates.