5 Reasons why the Cloud will POWER up the Financial Industry

Last year, Forbes made similar remarks suggesting that banks will need to embrace the cloud more in the next three to five years in order to stay in the game. As a consequence, this technological shift is said to be inevitable. But why, exactly?

1. The Cloud Prepares You for the Unpredictable

"CIOs looking to prepare their organization to thrive in the upcoming turns must take a differentiated approach to cloud computing."

At the beginning of this year, cloud computing was but an element of the corporate IT strategy, which needed to be taken into serious consideration. Given today’s circumstances, it’s becoming increasingly apparent that cloud-driven solutions are essential for the modern business environment. They’re tools that can help companies maintain business efficiency and save resources, especially on markets disrupted by startups leveraging the latest technologies.

Nobody knows when to expect a global crisis or how long it may last. Thus, enterprises of any size need to be prepared to be as scalable and efficient as they can be – and that includes financial institutions.

2. The Cloud Gives You More Control Over Your Resources

After the 2008 financial crisis, the banking industry came back strong and reached a satisfying level with a double-digit return on capital in previous years. To make money, however, banks need to rotate it. With the current economic slowdown, market demands are now lower than they were in the previous quarter. And even though institutions such as The Federal Reserve make decisions to cut interest rates, it may not be enough to stimulate consumption. The results? Banks could lose a big chunk of their margin.

So, if it’s about savings, what can financial institutions do to keep more of their money for a rainy day? According to Financial Insights, some of the biggest global banks generate savings of about $15 billion from cloud adoption, cutting technology infrastructure costs by 25%.

Executives of mid-sized U.S.-based institutions are a bit more skeptical. It’s not uncommon that a lower total cost of ownership is not considered one of the results of introducing a cloud environment. Entrepreneurs such as Frank Wasson, CEO of First Entertainment Credit Union, say that “it’s a myth that it’s cheaper.” But what will happen if we take the fourth dimension of the investment–time–into account (especially now, in Q2 of 2020)? It then turns out that costs can be cut on multiple levels. Making the environment scalable and straightforward is always the way to do this.

3. Hybrid Clouds are on the Rise

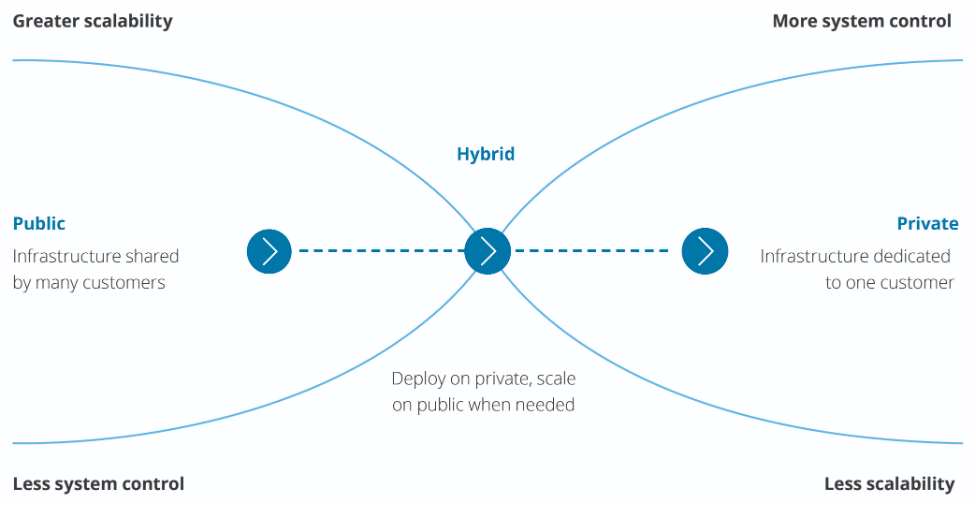

Though the term "hybrid" is often used interchangeably with "multicloud", what we mean by “hybrid cloud” is, essentially, a combination of an on-premises, private and public cloud where all of these elements communicate and work in unison, as presented below in the graphic by Deloitte.

According to research conducted by IBM in 2018, nearly half of all financial organizations are limited by the lack of appropriate in-house skills related to introducing a robust hybrid cloud strategy. Luckily, some cloud providers can deliver a full ecosystem for effective hybrid cloud management, giving their clients access to the right platform, software and services.

As for managed cloud services providers, hybrid cloud management is often part of their offer. Comarch, for example, a global provider of software-defined IT products for improving business efficiency, provides support in managing both an on-premises hybrid cloud and multicloud infrastructure. The company says that communication between its IBM Power Cloud solution, an x86-based cloud, and an on-premises system is also possible.

4. The Cloud Helps You Stay in Line with the Latest Regulations

Cloud-driven systems and service can also help banks perform day-to-day liquidity calculations and risk estimates and detect various fraudulent activities such as money laundering. Considering that many companies are now focusing on incorporating the latest AI/machine learning technologies into their cloud-based solutions, we should expect them to become even more valuable for the financial industry in the near future.

5. IBM Power Systems are Available in the Cloud Model

That is because IBM Power Systems have finally become available in the cloud model. As a result, companies such as Comarch are now offering their services to enterprises all over the world, helping them migrate their existing IBM-based infrastructure to the cloud.

Thanks to solutions such as Comarch’s Power Cloud, users can also expect the technology provider to take care of their infrastructure, middleware and OS components. That will allow them to reduce workload, freeing up their IT resources for other business-relevant activities.

Guaranteeing top system performance and unmatched reliability, Power servers are still used by the majority of financial institutions. But now, thanks to the cloud and capacity on demand, we are most probably about to witness them becoming even more popular.