Paper Invoices in Vietnam are to be Replaced by Electronic Ones

Vietnam still uses paper invoices, but it does not intend to continue doing so. In addition to the traditional form, it is now also possible to use electronic invoices. Going one step further, the Vietnamese government wants e-invoicing to become the main solution in July this year.

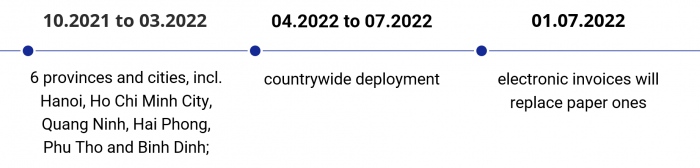

The entire project is to be carried out in three phases. The first two include a pilot program. First, the solution will be tested in selected provinces. In the second phase, the pilot program will be extended to the entire country. After these stages, the use of electronic invoices will become mandatory for all taxpayers.

The two types of e-invoicing processes have not been altered in the new law: one using e-invoices with GDT tax verification codes, and one without.

There are different ways to submit invoices to the tax authorities, including:

- Transmit data in e-invoices directly to the General Department of Taxation

- Transmit data through a service provider

There’s more you should know about e-invoicing in Vietnam – learn more about the new and upcoming regulations.