XRechnung – Quoting VAT on Used Parts

What has changed with electronic invoicing and how to solve problems regarding differential taxation

On the GK Comarch websites, both we and our partners use cookie files and targeting. Cookie files (a.k.a. "cookies") are small text files sent to your browser by the site you visit at any given time. They are used for analytical and statistical purposes as well as to ensure the proper functioning of the site. Additionally, they are used to tailor marketing content to the interests of users visiting our sites.

As we respect your privacy, we ask for your consent to use these technologies. You can consent to cookies by clicking "Accept all". If you want to personalize your choices, click "Settings." You can withdraw your previous consent or change your preferences at any time by clicking the "Settings" button.

Using cookies for the purposes indicated above is related to the processing of your personal data. The administrator of your data is Comarch SA. In some cases, our partners may also be the administrators of your data.

For more information on how we and our partners use cookies and process your personal data, please see our Data Processing Notice and Cookie Policy.

XRechnung – Quoting VAT on Used Parts

What has changed with electronic invoicing and how to solve problems regarding differential taxation

The method originally suggested by the Coordination Office for IT Standards (KoSIT) for indicating the abovementioned tax in electronic invoices contradicted the business rules for XRechnung prescribed by the authorities, which resulted in invoices being rejected.

Comarch has developed a solution for the correct indication and validation of that special form of VAT in e-invoices that use the XRechnung standard. The workaround was implemented as part of a global e-invoicing project with MAN Truck & Bus SE. It allows companies from the automotive industry to state the VAT correctly in their electronic invoices while authorities are working to adjust the regulations regarding this topic and enable proper validation.

One of the questions listed in the FAQ section of the KoSIT website was how differential taxation (such as VAT on used parts) should be indicated in invoices that use the XRechnung standard.

The answer stated that invoice issuers were to indicate differentiated taxation as per section 25a of the German Value Added Tax Act (UStG) in a separate invoice line. For that invoice line, they were to choose the VAT tax category code E (“Exempt from VAT”) from the code list UNTDID 5305, while also taking into account the appropriate business rules (BR-E-1 to BR-E-10). The note pointing out the differentiated taxation was to be transmitted in the BG-1 Invoice Note.

How that was to be put into practice was unclear since, according to BR-E-5, the “Invoiced item VAT rate” (BT-152) must equal “0” if the “Invoice Line” (BG-25) in the “Invoiced item VAT category code” (BT-151) has the value “Exempt from VAT”. This rule cannot, however, apply to VAT on used parts as its rate does not equal “0”. Upon contacting KoSIT and calling their attention to the mistake, Comarch was told that the section of the FAQ would be deleted and that the BMF (German Federal Ministry of Finance) would be contacted to find a solution to the problem. So, while it has yet to be fixed, the error is rather obvious.

That being said, the problem regarding the tax category code is not the only difficulty that VAT on used parts presents.

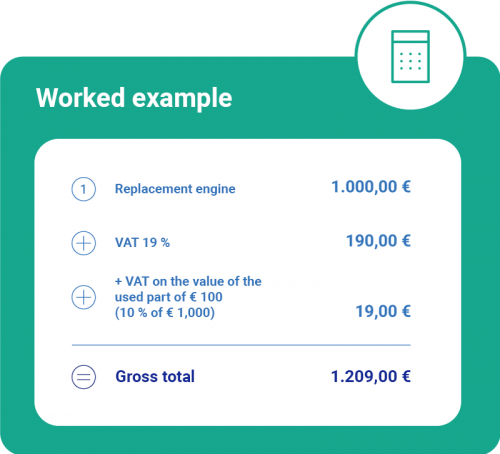

A second problem becomes apparent once you take a look at how the tax is calculated.

The VAT on used parts equates to the full current VAT rate levied on an assessment basis, to be determined as per section 10 (2) sentence 2 UStG. The assessment basis is an average value defined as being 10% of the list price of the equivalent new component (exclusive of discounts and VAT).

Since the assessment basis for the used part is defined as being an average value of 10% of the list price of the equivalent new part, the VAT on the value of the old part has to be calculated in a separate invoice line (19% of €100). Up to this point, the process is in line with KoSIT recommendations. The problem now, however, is that the full net value has already been taxed and that you cannot repeat the taxation without falsifying the net total since you would have to increase it by the “fictive” assessment basis for the used part in a separate invoice line.

Numerous companies are currently facing these difficulties – after all, the VAT in question affects automotive businesses and manufacturers whose products are bound to need some parts replaced eventually.

If you too are struggling with this problem, please do not hesitate to contact us.

Visit our website to learn more about Comarch EDI: